Multi Family Real Estate Investing for Income and Wealth

Investing in Multi Family Real Estate

Multi family real estate investing is the purchase of a residential property with five or more dwelling units for the purpose of renting the units to others for a profit. The property purchase may be done alone or in a syndicate with others.

The best real estate investment strategies depend on each investor's goals, risk tolerance, investible assets, net worth, and other specifics of their situation.

There are compelling reasons why Urban Equities focuses our practice on "Garden Style" multi family real estate - the real estate investment class that we believe is the most advantageous for many sophisticated or accredited investors.

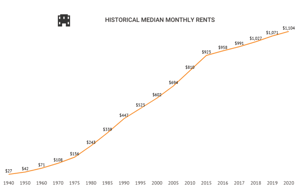

Rent Growth

Research from CBRE, the world's largest commercial real estate brokerage firm, indicates that the double-digit rent growth in multi family real estate is significant. They observed similar conditions in the run-up during the dot-com era only in the Bay Area and Boston.

While the current rate of growth in rents is projected to moderate from its current 9.4% pace to 6% at the end of the year, 2022 would still rank as the second highest rent growth on record. Only 2021 was higher.

Furthermore, of the 50 largest multifamily markets in the nation, only Las Vegas, Sacramento, Minneapolis, Phoenix, and Palm Beach have full year rent forecasts below their five-year pre-pandemic average. Thus, most markets should register solid rent growth at the end of 2022.

Falling Home Affordability

According to the National Association of Realtors1, the Housing Affordability Index has dropped by close to a third in just this year alone. The Housing Affordability Index is what’s used to measure whether a typical family can afford a mortgage loan on a typical house based on their income.

It's also an important number for multi family real estate investors to monitor because it represents the relative appeal of renting. When fewer people buy, more rent, and when more rent, demand exceeds supply and rents increase accordingly.

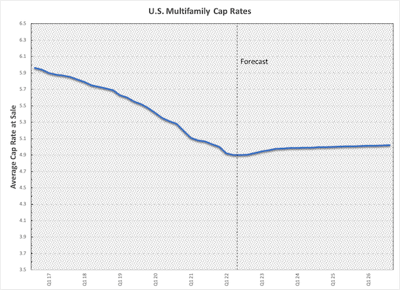

Rising Investor Returns

Throughout modern American history this investment class has been an unmatched wealth builder. Yields have grown as investors in other real estate asset classes have shifted portions of their portfolios to multi-family investments.

Cap rate is an industry term that describes the premium an investor is willing to pay for an income stream. The lower the cap rate, the higher the premium. Cap rates on multifamily properties have never been lower and with other asset types losing favor due to inflation headwinds, more cap rate compression is likely.

Real estate investing is not new. Over the last two centuries, about 90 percent of the world’s millionaires have been created by investing in real estate2.

The important question is what real estate asset class? Should I invest in single family residential, multifamily, hotel, retail, office, industrial, storage facilities, mobile home parks, or vacant land. The list is long, but we are nevertheless convinced that the best real estate investment strategies are found in multi-family real estate for several reasons:

- Perpetual repricing

- Inflation hedge

- Tax advantages

These are important factors for investors to consider.

Constant Mark-to-Market

Most every real estate class is limited by “Loss-to-Lease” costs. Loss-to-lease is the economic cost of allowing space to be rented for less than the market value.

When a tenant signs a lease, he is granted possessory rights at an agreed price for an agreed period of time, even if the market value of that space increases. The most important event in pricing management is the “Mark-to-market” event.

When a lease expires the space is repriced, or marked to the market rate. As a landlord (or investor), I want all my units to be priced at the market price but I have to honor the leases in place.

If I own a 100-unit multi-family building, roughly 8 units will “mark-to-market” every month. Compare that to a ten-space retail center with a mark-to-market tempo of approximately one space per year or a four-tenant office building with a mark-to-market tempo of one space every two years.

A single-tenant industrial building may only mark to market once every ten years!

These are estimates based on the lease characteristics of each class and will vary, but with the exception of mini-storage facilities (which have some undesirable characteristics) multi family real estate wins the mark-to-market battle.

The Best Hedge Against Inflation

Among real estate asset classes, multifamily properties are the closest thing to a true hedge against inflation.

Why do we need to mark-to-market? Because inflation is constantly diminishing the value of your cash flow. In 2022 annual inflation is at 9% and the common annual escalation clause in leases allows for just a 2%-3% increase. And for some asset classes that may actually be the good news!

All retail landlords want and need a regional or national tenant to “anchor” their shopping center. Such tenants use this knowledge to negotiate low rental rates and worse, limited or no annual rent increases. As a shopping center landlord, I may get a Starbucks on the end cap of my center - which is great for putting my center on the map, but marquis tenants will normally be paying the lowest rent and require a 20-year lease with one 10% increase every five years.

In this retail scenario, if inflation falls to just 5%, the inflation-adjusted value of your cash flow will have fallen by 38.75% in ten years.

Office and Industrial landlords struggle similarly. Even though few office tenants have the brand swagger to cut deeply into rental rates, they do write long leases which are punishing to landlords when inflation is elevated.

The Best Tax Advantages

In 2017, Congress passed the Tax Cuts and Jobs Act of 2017 (TCJA). It included a provision for an individual to qualify for Real Estate Professional Status3 (REPS.) This granted an exception to the passive loss activity rules, and is important because most accredited real estate investors are passive investors rather than active investors.

To qualify as a real estate professional, a taxpayer must meet the following two criteria according to (IRC Sec. 469(c)(7)(B):

- First, more than one-half of the personal services performed in all trades or businesses by the taxpayer during such taxable year are performed in real property trades or businesses in which the taxpayer materially participates, and

- Second, such taxpayer performs more than 750 hours of services during the taxable year in real property trades or businesses in which the taxpayer materially participates.

If you can document these requirements, you may use your passive losses such as depreciation to offset your non-passive income such as W2 or 1099 income.

Bonus Depreciation. Another change brought on by the TCJA was the doubling of bonus depreciation from 50% to 100%. This is a limited-time benefit for those who purchase real property and complete a cost-segregation study in order to allocate all the improvements into their appropriate depreciation lifetimes, and then accelerate 100% of the value of these improvements to be written off in year-1.

Multifamily properties necessarily accumulate constant improvements. No other property type can compete with the run-up of costs associated with flooring, kitchens, appliances, light and plumbing fixtures, paint, landscaping accouterments, etc.

Under the code, all these costs are written off as a passive loss in year-1. This provision sunsets over time. The benefit drops to 80% of new improvements in 2023, 60% of new improvements in 2024, 40% of new improvements in 2025, and 20% of new improvements in 2026.

Under the current rules, a multifamily renovation project can earn an LP who is a REPS an offset of roughly 100% of the investment dollars with first year depreciation such that a $100,000 investment would save roughly $35,000 in first year federal income taxes!

Multi family real estate investing is appealing for many reasons but its the project development cycle that takes most would-be investors out of the game. Sourcing opportunities requires constant engagement with multifamily brokers, lenders, and other owners. Underwriting deals (establishing one's opinion of value) takes time, experience, and lots of subscriptions to analytics platforms. Acquiring financing requires constant financial reporting management and key relationships with myriad lenders, lender brokers, and capital markets advisors. Raising equity requires either a very deep pocket or very large investor database. And even with a great business plan, there might be nothing you can do to convince the seller to sell the property to you. But even high-net-worth individuals may not have the resources to individually purchase 50, 100 unit or larger complexes. Multi family investment companies can help.

What Does Multifamily Syndication Mean?

In the simplest form, a syndicate is an association of people or organizations that is formed for business purposes in order to carry out a project.

Multifamily syndication, in today's vernacular, is a specific type of enterprise, namely, a "private offering" sanctioned and governed by the Securities and Exchange Commission (SEC).

Under SEC rules, a private offering of securities exists any time there are one or more parties with unlimited risk and management control (The GP or Sponsor) plus one or more parties with limited risk and no management control (the passive investor or LP).

Private Security Offerings must follow SEC rules related to disclosure and vetting of investor eligibility (not just anyone may participate). The Sponsor is responsible for following the law in all matters related to the offering. The beauty of the syndication model is that passive investors have access to deals that are already underwritten, negotiated, inspected, and merely awaiting closing.

SEC rules also govern the profile of individuals who can invest passively in syndicates. The distinction between an accredited investor vs. a sophisticated (qualified) investor is an important one to understand.

Why Would You Want to Invest in Multifamily Syndication?

Perhaps there is no a one-size-fits-all solution for buying and holding real estate, but we do make the assertion that multifamily syndications are the vehicle of choice for those with $25,000 or more to invest but lack the time, experience, or inclination to go it alone. A syndication affords the aforementioned candidate the opportunity to participate in the cash flow, value growth, and tax benefits associated with large-scale real estate investing with significantly less financial risk and significantly less opportunity cost. In a syndication, the LP is a passive investor whose risk of loss is limited to their investment. The Sponsor, indemnifies the LP against further loss. If you have responsibilities other than buying, managing and selling investment real estate, then you need the syndication model because this method of acquiring an investment starts after the project development cycle is complete. If you are running your own practice or business, this arrangement allows you to focus on a simple go/no-go decision rather than committing to all the preceding steps, any of which capable of stopping the process and forcing you to start again at the top.

Understanding How a Real Estate Syndication Deal is Put Together

How does the process begin? As a passive investor, you will learn about an investment opportunity directly from us, the syndicator, in the form of an offering. When an offering is made, the sponsor has already identified the property, underwritten a financial and business plan, negotiated the terms of sale, completed inspections and other due diligence, and will already be working with a lender to source and finalize the financed portion of the purchase price.

Ownership is typically divided up in a manner whereby the sponsor earns a disproportionate percentage of the profits in exchange for

(a.) executing the project development cycle: that is all the work done identifying and underwriting the property, securing the financing, committing to the borrower covenants, qualifying for the loan, raising the equity from investors, and;

(b.) managing the ongoing operation after it is closed.

There are limitless variations on how these investments are structured but our structure rarely departs from the following: The equity for the purchase, that is, the money needed for the down payment, working capital, and closing costs, are contributed by the passive investors (LPs), and this group makes up 80% of the ownership of the enterprise and the sponsor or sponsor team (GP) makes up 20% of the ownership. In virtually all cases where a lender is involved - and in all of our transactions, the sponsor not only participates in the GP (20%) side, but also has a significant investment in the LP side.

Most entities are formed as limited liability companies and are treated as partnerships for tax purposes. The Operating Agreement will lay out the company's plan for distributions and payouts to investors. Our normal method is simple: Each quarter we distribute the available cash flow, 80% to passive investors, and 20% to the sponsor. Ownership percentages usually follow an investor's pro-rata percentage of the total LP investment but occasionally, favor is awarded to larger investments. The Sponsor usually receives a monthly asset management fee of 2% - 5% of total income. When the property sells, the LP group shares 80% of the profits and the sponsor gets the other 20% of the profits.

How Much Money Can Investors Make from Investing in Multifamily Syndication?

Investor returns vary. While this statement can be laid directly at the feet of Captain Obvious, investor returns vary for reasons not so obvious. Every property is subject to unique market and environmental forces, and that alone makes every deal unique, but more than that, different sponsors also plan for variant financial outcomes. A passive investor should clearly understand the sponsor's plan prior to investing. An investment opportunity will have a planned time horizon. It will have a target earnings goal. Passive investors must understand these plans and also know the track record and deal history of a sponsor. Some sponsors specialize in identifying 5-star properties that they intend to hold for no less than 10 years. Longer-term-hold investments such as this attract wealth-preservation investors rather than yield-sensitive investors. Urban Equities is focused on opportunities that we believe can be improved through strategic value-add practices, our core competence in a 3- to 5-year time horizon. More specifically, we focus on interior and exterior renovations, expansion of community amenities, and improvement of management practices. Our benchmark for a go / no-go decision is simple. Are we confident we can deliver a 1.7% equity multiple over the life of the investment. To say it another way, when an LP invests $100,000, we expect him to depart the investment with at least $170,000.

1 - National Association of Realtors Housing Affordability Index

2 - 90% of the World’s Millionaires Do This to Create Wealth

Why Urban Equities & Multifamily Real Estate

800%

US rent growth since 1960

3.8 Million

Additional housing units needed to meet current US demand

87.5 Million

Americans cannot afford a median price home

Passive Investing

Lets real estate professionals source, underwrite, negotiate, and finance sensible investment opportunities so that those with limited time can participate in the profits and tax benefits of ownership.

Active Investing

Should be limited to those who are in the market daily and have multifamily management experience and for those who are investing strictly for their own account.

What's Best For Your Goals?

30 minutes, no charge or obligation - your agenda, Randy's expertise. Let's see if Urban Equities can help you hit your investment goals.